2025 Roth Ira Contribution Limits - What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. For 2025, 2025, 2025 and 2025, the total contributions. IRA Contribution and Limits for 2023 and 2025 Skloff Financial, That means you'll be able to stash away up to $7,000 in a roth ira in 2025, up from. Highlights of changes for 2025.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. For 2025, 2025, 2025 and 2025, the total contributions.

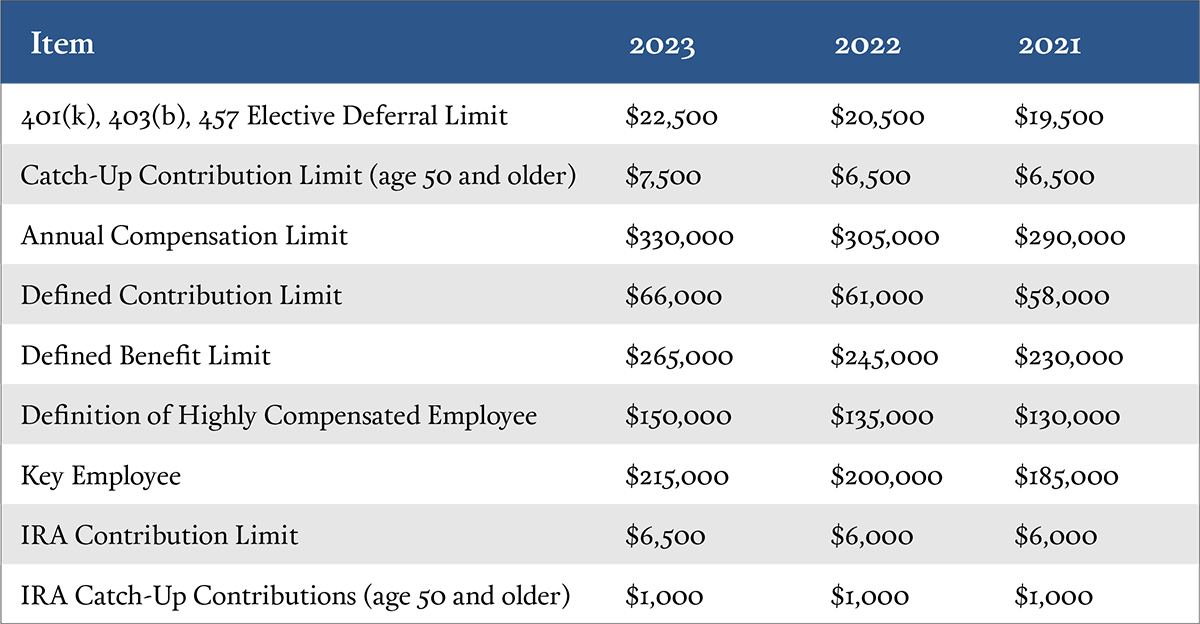

The maximum annual contribution for 2023 is $6,500, or $7,500 if you're age 50 or older, and you can make those contributions through april of 2025.

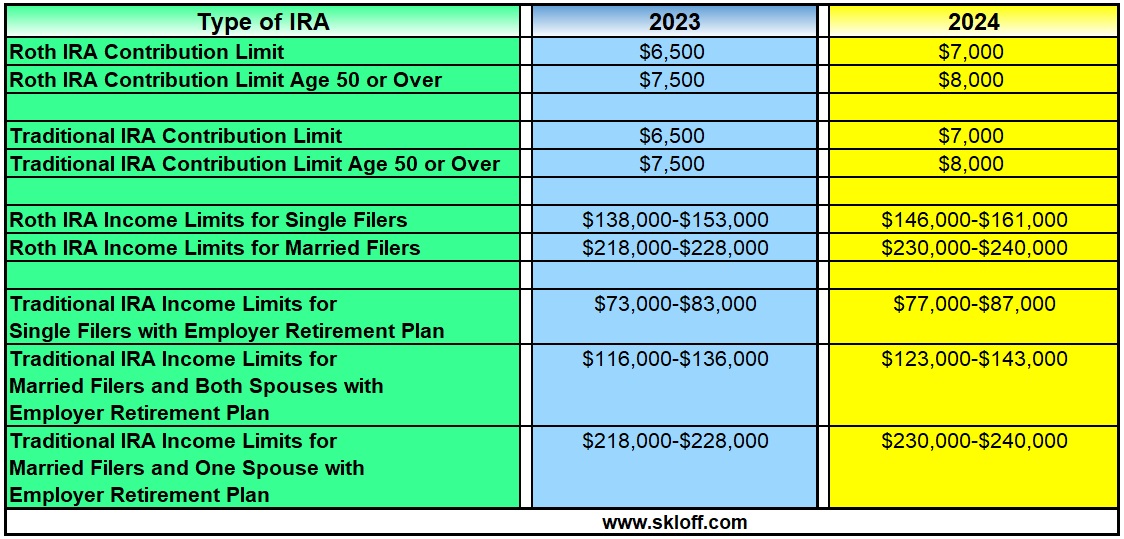

simple ira contribution limits 2025 Choosing Your Gold IRA, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. $8,000 in individual contributions if you’re 50 or older.

12 rows if you file taxes as a single person, your modified adjusted gross.

IRS Unveils Increased 2025 IRA Contribution Limits, For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for individuals. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

non working spouse ira contribution limits 2025 Choosing Your Gold IRA, That means you'll be able to stash away up to $7,000 in a roth ira in 2025, up from. $6,500 for 2023 and $7,000 in 2025, though if your income is less than the.

2025 Roth Ira Contribution Limits. If you're eligible for this extra savings boost, be. $8,000 in individual contributions if you’re 50 or older.

Roth IRA Limits 2025 Debt Free To Early Retirement, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year is $6,500 and $7,500 if you're. If you are 50 and older, you can contribute an additional $1,000 for a total of.

Irs Limit 2025 Winny Kariotta, If you're eligible for this extra savings boost, be. If less, your taxable compensation for the year.

New IRS Indexed Limits for 2023 Aegis Retirement Aegis Retirement, If less, your taxable compensation for the year. Highlights of changes for 2025.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year is $6,500 and $7,500 if you’re.